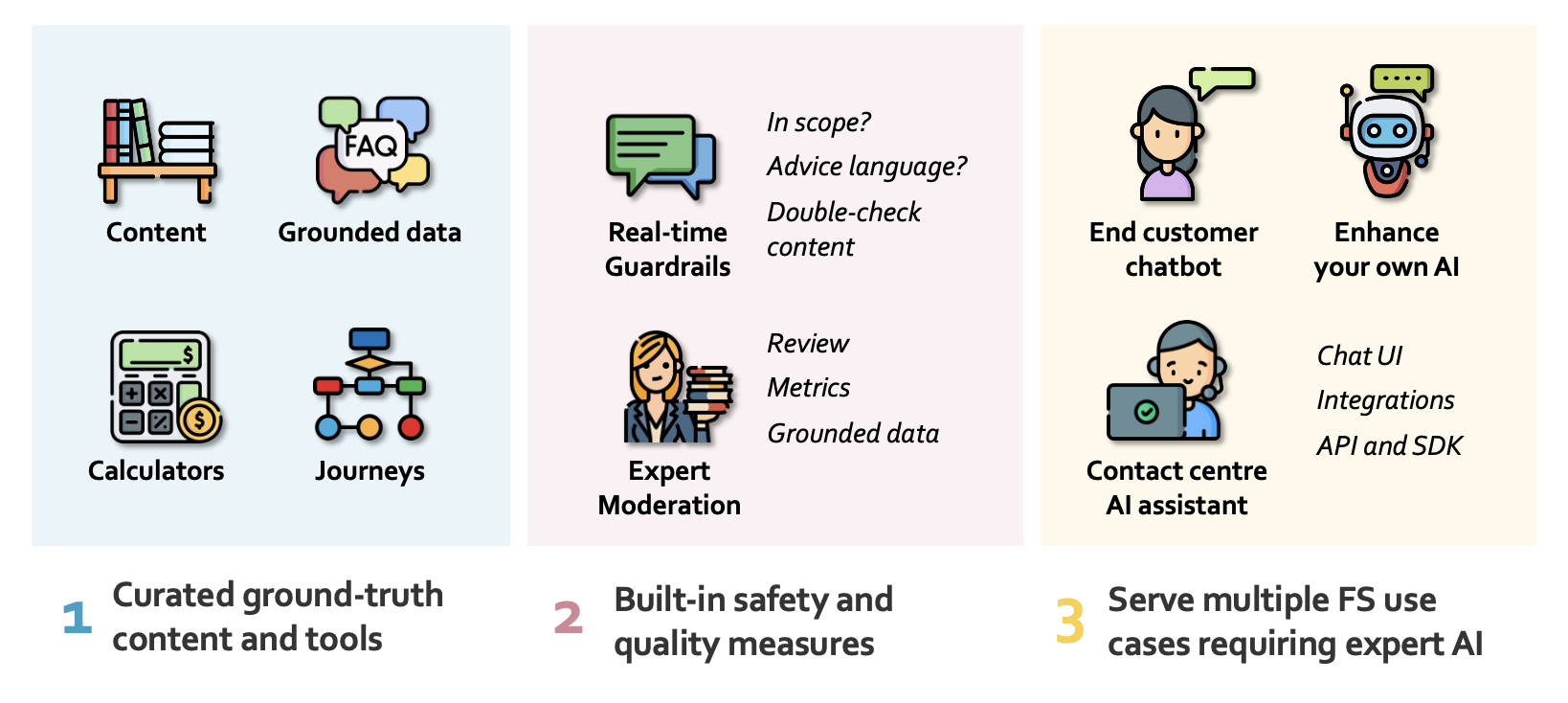

Closing the financial guidance gap.

The financial advice and guidance gap in the UK is huge with 15m-25m consumers needing guidance but unable to access it or unable to afford it.

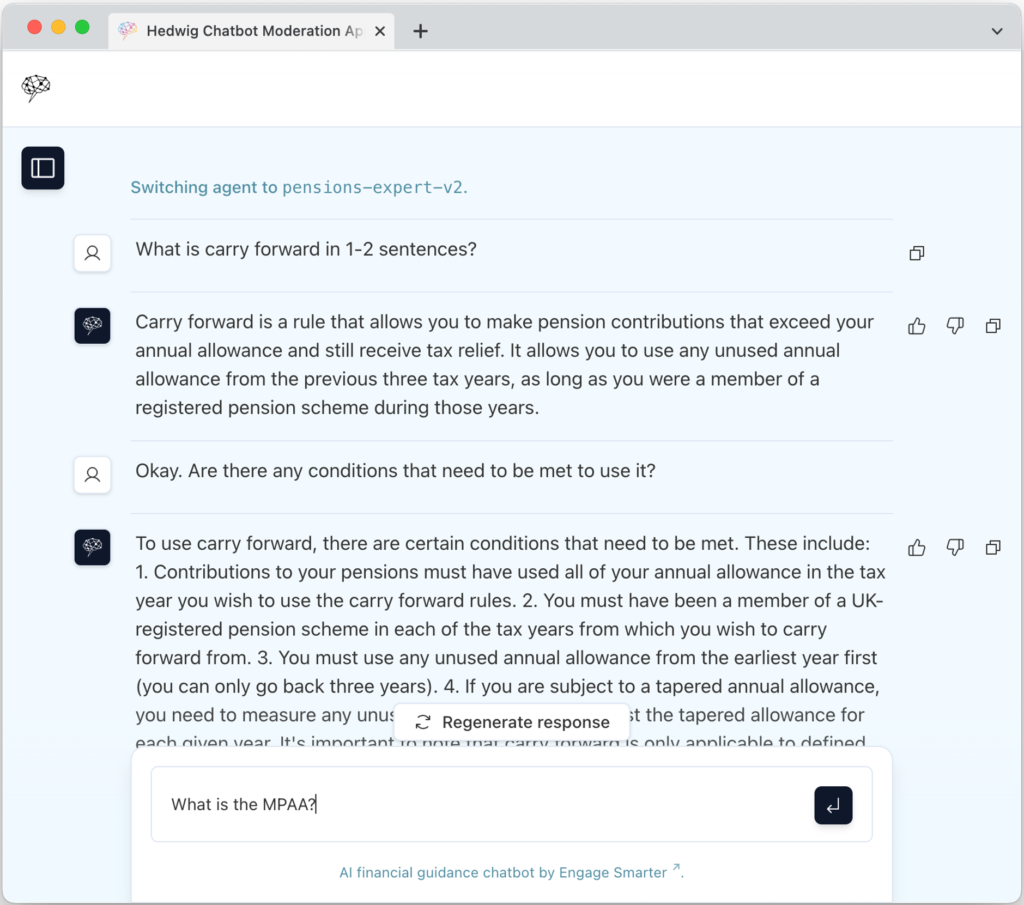

Bringing together automated financial guidance tools with AI enables more consumers to have access to intelligent and reliable guidance at a much lower cost.